Employment

Entering the Workforce

Going directly to the workforce can be a good option for furthering your goals or finding a life-long career. Many local employers look forward to hiring directly from our local high school graduates and give options for advancement to their employees. Below you’ll find resources for finding jobs, tips to understanding your benefits and pay, as well as some employers in our area.

Be Aware of your Benefits!

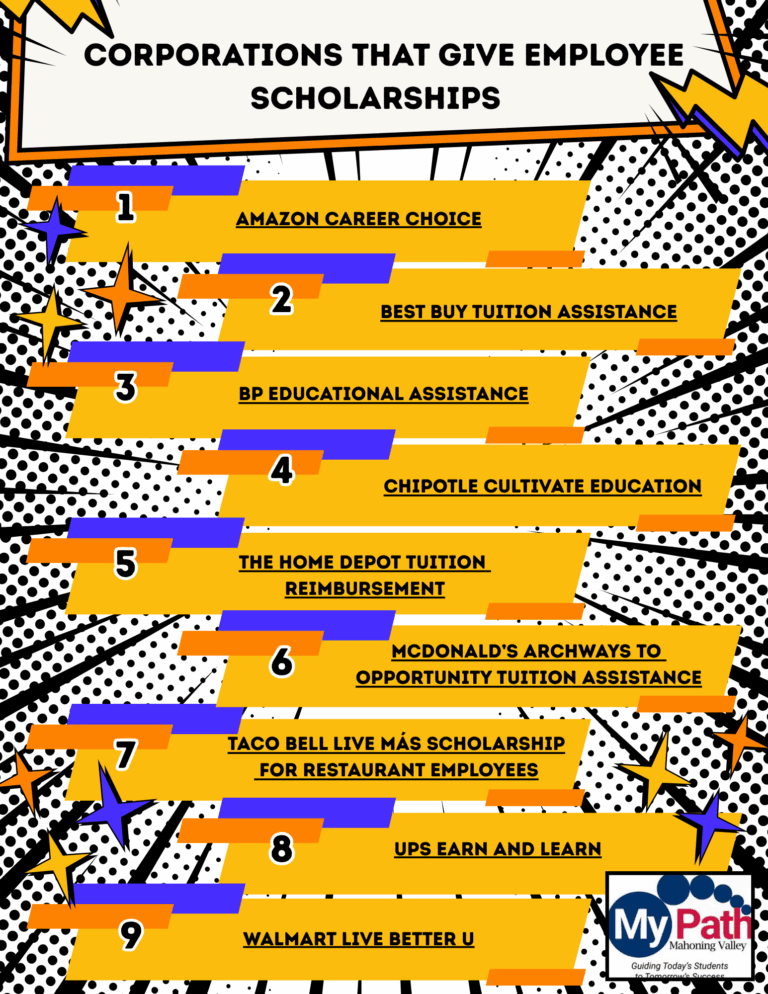

Some employers offer scholarships for employees to further their education. It is advised that you contact the HR representative at your job to understand what is offered to you outside of your paycheck.

Part-time vs. Full-time

If a job offers you part-time employment at $15 while another job offers you full-time at $10, which pays more per month? What benefits are they offering?

The answer is: the job that pays $10 for full-time employment will pay more a month than the part-time job that pays $15.

160hrs a month (4 weeks at 40hrs) x $10 = $1,600

80hrs a month (4 weeks at 20hrs) x $15 = $1,200

In addition, a full-time job often offers more benefits such as a healthcare plan, a 401(k), and even a HSA (Health savings account).

While it can feel like a lot, these are important factors to understand when applying for jobs. It is important to not go for the job thats pays the most but the job that supports you the best.

What is a 401(k)?

A 401(k) is an employer sponsored retirement plan. You can put money into this account from your paycheck and it will be invested depending on what option you choose through your companies 401(k) plan. Some employers even have matching programs where they match your contributions into your retirement account.

Understanding Healthcare Plans

Healthcare plans can be confusing and long-winded – how do you know whats best for you? When provided by your employer, there are often specific services outlined by each healthcare plan; some may not include benefits provided with others, such as vision and dental insurance. It’s best to understand your needs and how much you spend on average for your healthcare to choose the best plan for you.

If you cannot receive healthcare through your place of employment you can find options through the healthcare marketplace. You can find more resources on that below.

Employers in our area

Manufacturing

Sales

Retail

Healthcare

Services

- Enviroscapes

- Starwood Tree Service

- Old Avalon Golf Course

- 3JD Lawn Care Services

- The Cleaning Authority

- Environment Control of Beachwood, Inc

- Cornicelli Cleaners

- Certified Oil

- 7-ELEVEN

- Sheetz, Inc

- SERVPRO of East Mahoning County

- Trumbull County

- Firestone Complete Auto Care

- Midas

- Super Tire and Muffler Inc.

- Westside Tire & Service

Food Service

Childcare

Hospitality

- Niles Residence Inn by Marriott

- Niles Hampton Inn by Hilton

- Holiday Inn Express & Suites Youngstown N (Warren/Niles)

- Best Western Park Hotel

- Holiday Inn Express and Suites Austintown

- TPG Hotels & Resorts

- Hampton Inn Youngstown Boardman

- Wingate by Wyndham Youngstown